Help & FAQs

What is KYC/AML?

In order to invest through CoinList, you need to pass identity verification and KYC/AML (Know Your Customer/Anti-Money Laundering) checks. These checks apply equally to U.S. and non-U.S. residents. In general, you will need to provide name, address, a selfie, and government-issued ID image.

You can learn more about KYC/AML here.

Information on MINA Staking

1. What is MINA staking?

MINA is the native utility token for the Mina blockchain. Instead of using miners and a Proof-of-Work (PoW) consensus mechanism to verify transactions and maintain the integrity of the Mina blockchain, Mina uses a Proof-of-Stake consensus mechanism. This means that network participants are able to stake a certain amount of MINA for the right to honestly verify transactions on Mina and receive rewards for doing so. Additionally, MINA owners are able to lock their tokens and vote for these network participants, known as validators. MINA holders that lock and vote their tokens receive additional MINA as a reward for voting for honest and active validators on the network. CoinList manages the locking and voting for users who deposit MINA into their CoinList wallet so they can passively receive additional MINA.

2. How do I earn MINA staking rewards on CoinList?

When you deposit or purchase MINA on CoinList, you may be eligible to receive staking rewards by keeping MINA in your CoinList Wallet. Once you deposit MINA into your CoinList Wallet, you are automatically opted into staking rewards. There is no action on your end required to participate. Please note that MINA held on CoinList Pro do not earn staking rewards.

3. How much are MINA staking rewards?

You can find the most current staking reward amount on the Staking page (https://coinlist.co/staking) of your account. Please note that CoinList does not guarantee any reward will accrue, and the amount of the reward is subject to change at any time. The estimated reward takes into account CoinList’s fee.

4. What fees are charged for this staking service?

A 15% fee will be taken from your earned staking rewards. Your staked principal will not be affected by the fee.

5. Do I have to buy my MINA on CoinList to earn staking rewards?

No. Users who have procured their MINA from other means or trading venues are able to deposit their MINA into their CoinList Wallet and automatically be enrolled in the staking rewards program.

6. Who is eligible to earn MINA staking rewards on CoinList?

Anyone who is able to open up a wallet on CoinList and deposit MINA into their account is eligible for MINA staking rewards on CoinList. CoinList Wallets are not available in all jurisdictions, please visit this page to see our list of approved jurisdictions. Not available for citizens and residents of the US and Canada.

7. What are MINA staking rewards paid out in?

MINA staking rewards on CoinList are paid out in MINA. This means you will accrue additional MINA by keeping your MINA in your CoinList wallet.

8. When will I receive my MINA staking rewards?

Once per month, CoinList will distribute rewards to users pro-rata of their average holdings over the month. We will notify you via email once your rewards have been distributed into your CoinList wallet.

9. Will my staking rewards be automatically re-staked? Are MINA rewards compounding?

Yes, your MINA staking rewards are automatically re-staked and earning additional rewards unless you withdraw or trade them. MINA rewards are compounding daily, but are only distributed once per month.

10. Who is the MINA staking provider for CoinList?

Currently, MINA tokens held in CoinList Wallets are delegated to Figment, a professional staking service.

11. Can I choose who my MINA tokens are delegated to?

CoinList does not include the functionality to choose to whom your tokens are delegated (i.e. they are automatically delegated to Figment). In order to choose who your tokens are delegated to, you will need to transfer your MINA tokens to a wallet that you control yourself.

12. How do I opt-out of MINA staking rewards?

You will automatically receive staking rewards by holding MINA in your CoinList Wallet. If you would like to opt-out of MINA staking rewards, go to the Staking page > Select MINA > Select “…” for more options > Toggle “Auto stake assets” off. Please note that if you opt out of staking, your earned staking rewards will be distributed at the end of the month along with the regular staking reward distributions. You will not receive your earned staking rewards early.

For Mina Token Sale participants only:

13. Have I been earning block rewards since the sale date?

Yes. The MINA tokens you purchased have been earning staking rewards since the sale. These accrued rewards will be paid into your CoinList Wallets on May 31 when your tokens unlock.

14. How do I earn “Supercharged Rewards”?

“Supercharged Rewards” are automatically enabled for the MINA tokens you purchased on CoinList. You do not need to take any action to activate these rewards. The staking rewards you will be paid on May 31 (and each month thereafter for the first 15 months after mainnet launch) include Supercharged Rewards. More information about Supercharged Rewards can be found here.

Is there a contact email?

All questions can be sent submitted through our help portal.

What is Karma?

Karma is a point system that rewards you for your activities on CoinList. Karma increases your chance of getting into Token Launches and exclusive offers when you contribute to crypto protocols. Earn for doing good for crypto!

Our Karma program continues to evolve and as it does, we will provide additional information. CoinList retains the right to modify the terms of the Karma program at any time.

How long do ether transactions take?

CoinList waits for 30 confirmations to consider an ETH or ERC-20 transaction final. Although typically this should only take about ~ 5 minutes, this can take anywhere from 5 minutes to 4 hours. Especially during periods of high network congestion, the transaction can take longer. You can see the number of confirmations in your CoinList wallet.

How do I redeem Wrapped Bitcoin (WBTC) for BTC?

To unwrap WBTC into BTC, you first need to have WBTC in your CoinList wallet. Once your wallet is funded with WBTC:

- Click “Unwrap” from inside your WBTC wallet.

- Enter the amount of WBTC you wish to swap into BTC

- Click “Confirm Unwrap” to receive BTC directly in your BTC wallet.

WBTC will be debited from your WBTC wallet and you will receive BTC in your BTC wallet.

Please note that you will have two different wallets. You will not receive BTC in your WBTC wallet.

Lost access to my 2FA device

If you have lost access to your 2FA device, you can use one of your account backup codes that you were asked to save after setting up two-factor authentication. If you no longer have access to these backup codes or have used all of them, please submit a support ticket.

Do not attempt to create a new account. CoinList does not accept duplicate accounts. If you create a duplicate account, it will be closed and you will have to proceed with a 2FA reset on your original account. Attempting to create a second account is in violation of our Terms of Service; Any violation of the Terms of Service may result in indefinite suspension of services and closure of a user's account.

Investors

What is KYC/AML?

In order to invest through CoinList, you need to pass identity verification and KYC/AML (Know Your Customer/Anti-Money Laundering) checks. These checks apply equally to U.S. and non-U.S. residents. In general, you will need to provide name, address, a selfie, and government-issued ID image.

You can learn more about KYC/AML here.

Is there a contact email?

All questions can be sent submitted through our help portal.

Transferring your AngelList login to CoinList

CoinList is discontinuing support for AngelList logins on CoinList. All legacy AngelList login users were assigned a CoinList account that is associated with their AngelList email. This account contains all of the CoinList account history associated with your AngelList login.

What do I need to do?

To login to your CoinList account, simply click “forgot password” on the CoinListlog in page to generate a new password.

The new password will be unique to your CoinList account and will not impact your AngelList account.

In order to access wallets and trading on CoinList, you may be required to submit additional KYC documentation and set up two-factor (2FA) authentication for your CoinList account.

Your AngelList 2FA will not carry over to your CoinList account. If you are experiencing issues with your 2FA, you may need to disable your 2FA and re-enable. You can find these settings under "Account" and "Security." If you continue to have issues, please submit a help request on our Help Center to have your 2FA reset.

If you have already completed these steps, then no further action is required beyond resetting your CoinList password.

Why do you need my SSN?

Your SSN is required under our KYC/AML policy, a process set by our banking provider. We verify US investor's social security number and birthdate against credit records then verify the investment signatory against OFAC and similar databases to flag prohibited or high risk persons and entities.

Rewards

Information on MINA Staking

1. What is MINA staking?

MINA is the native utility token for the Mina blockchain. Instead of using miners and a Proof-of-Work (PoW) consensus mechanism to verify transactions and maintain the integrity of the Mina blockchain, Mina uses a Proof-of-Stake consensus mechanism. This means that network participants are able to stake a certain amount of MINA for the right to honestly verify transactions on Mina and receive rewards for doing so. Additionally, MINA owners are able to lock their tokens and vote for these network participants, known as validators. MINA holders that lock and vote their tokens receive additional MINA as a reward for voting for honest and active validators on the network. CoinList manages the locking and voting for users who deposit MINA into their CoinList wallet so they can passively receive additional MINA.

2. How do I earn MINA staking rewards on CoinList?

When you deposit or purchase MINA on CoinList, you may be eligible to receive staking rewards by keeping MINA in your CoinList Wallet. Once you deposit MINA into your CoinList Wallet, you are automatically opted into staking rewards. There is no action on your end required to participate. Please note that MINA held on CoinList Pro do not earn staking rewards.

3. How much are MINA staking rewards?

You can find the most current staking reward amount on the Staking page (https://coinlist.co/staking) of your account. Please note that CoinList does not guarantee any reward will accrue, and the amount of the reward is subject to change at any time. The estimated reward takes into account CoinList’s fee.

4. What fees are charged for this staking service?

A 15% fee will be taken from your earned staking rewards. Your staked principal will not be affected by the fee.

5. Do I have to buy my MINA on CoinList to earn staking rewards?

No. Users who have procured their MINA from other means or trading venues are able to deposit their MINA into their CoinList Wallet and automatically be enrolled in the staking rewards program.

6. Who is eligible to earn MINA staking rewards on CoinList?

Anyone who is able to open up a wallet on CoinList and deposit MINA into their account is eligible for MINA staking rewards on CoinList. CoinList Wallets are not available in all jurisdictions, please visit this page to see our list of approved jurisdictions. Not available for citizens and residents of the US and Canada.

7. What are MINA staking rewards paid out in?

MINA staking rewards on CoinList are paid out in MINA. This means you will accrue additional MINA by keeping your MINA in your CoinList wallet.

8. When will I receive my MINA staking rewards?

Once per month, CoinList will distribute rewards to users pro-rata of their average holdings over the month. We will notify you via email once your rewards have been distributed into your CoinList wallet.

9. Will my staking rewards be automatically re-staked? Are MINA rewards compounding?

Yes, your MINA staking rewards are automatically re-staked and earning additional rewards unless you withdraw or trade them. MINA rewards are compounding daily, but are only distributed once per month.

10. Who is the MINA staking provider for CoinList?

Currently, MINA tokens held in CoinList Wallets are delegated to Figment, a professional staking service.

11. Can I choose who my MINA tokens are delegated to?

CoinList does not include the functionality to choose to whom your tokens are delegated (i.e. they are automatically delegated to Figment). In order to choose who your tokens are delegated to, you will need to transfer your MINA tokens to a wallet that you control yourself.

12. How do I opt-out of MINA staking rewards?

You will automatically receive staking rewards by holding MINA in your CoinList Wallet. If you would like to opt-out of MINA staking rewards, go to the Staking page > Select MINA > Select “…” for more options > Toggle “Auto stake assets” off. Please note that if you opt out of staking, your earned staking rewards will be distributed at the end of the month along with the regular staking reward distributions. You will not receive your earned staking rewards early.

For Mina Token Sale participants only:

13. Have I been earning block rewards since the sale date?

Yes. The MINA tokens you purchased have been earning staking rewards since the sale. These accrued rewards will be paid into your CoinList Wallets on May 31 when your tokens unlock.

14. How do I earn “Supercharged Rewards”?

“Supercharged Rewards” are automatically enabled for the MINA tokens you purchased on CoinList. You do not need to take any action to activate these rewards. The staking rewards you will be paid on May 31 (and each month thereafter for the first 15 months after mainnet launch) include Supercharged Rewards. More information about Supercharged Rewards can be found here.

Casper (CSPR) Staking on CoinList

Casper (CSPR) Staking on CoinList

1. What is Casper (CSPR) staking?

Casper is a layer-one blockchain built for application development and scalability. It aims to support enterprise applications without compromising cost, decentralization, or security. Casper uses a Proof-of-Stake (PoS) consensus protocol called Highway to secure the network and verify transactions. Casper rewards network participants for helping secure the blockchain through staking. CoinList will facilitate staking for users, for which CoinList takes a fee from staking rewards. Please note this fee is assessed only on the rewards earned and not your principal tokens. CoinList users who stake their CSPR receive rewards for their contributions.

2. How much are CSPR staking rewards?

You can find the most current staking reward amount on the Staking page (https://coinlist.co/staking) of your account. Please note that CoinList does not guarantee any reward will accrue, and the amount of the reward is subject to change at any time. The estimated reward takes into account CoinList’s fee.

3. How do I earn CSPR staking rewards on CoinList?

There are two ways to earn rewards while staking CSPR on CoinList.

Vault Staking (Discontinued)

Vault Staking has been discontinued for all assets.

Auto-Staking

Here all you have to do is hold your CSPR on CoinList and you will start earning rewards. Rewards for auto-staking will be distributed in the middle of the month.

4. When will I receive my CSPR staking rewards?

Your rewards will be credited to your account on a monthly basis.

5. Will my staking rewards be re-staked automatically? Do CSPR rewards compound?

Yes, CSPR staking rewards are re-staked automatically and will continue to earn rewards until you withdraw or trade the CSPR you are holding on CoinList (auto-staking). CSPR rewards compound daily, but are only distributed monthly.

6. Do I have to buy my CSPR on CoinList to earn staking rewards?

No. You may deposit CSPR into your CoinList Wallet and lock your CSPR to earn staking rewards.

7. When will I be able to withdraw my CSPR staking rewards?

You can withdraw or trade unlocked CSPR any time.

8. Who is eligible to earn CSPR staking rewards on CoinList?

With the exception of US and Canadian residents, anyone who is able to open a wallet on CoinList and deposit CSPR into their account is eligible for CSPR staking rewards on CoinList. CoinList Wallets are not available in all jurisdictions, please visit this page to see our list of approved jurisdictions.

9. What are CSPR staking rewards paid out in?

CSPR staking rewards on CoinList are paid out in CSPR. You will not earn any additional rewards in ETH or any other digital asset or token.

ETH Trading Bonus for NuCypher WorkLock Participants

Eligible CoinList users who trade qualifying crypto during the promotion period (1.11.2021 - 1.31.2021) may be eligible to receive a bonus in ETH paid directly to your CoinList Wallet. To be eligible to participate in this promotion you must have participated in the NuCypher WorkLock on CoinList. Bonuses are calculated based on total traded volume in USD during the promotion period, and will be paid out as a flat payment based on the tiers outlined in the payout structure below:

- Tier 1: $5,000 - $19,999 → earn $15 in ETH

- Tier 2: $20,000 - $49,999 → earn $50 in ETH

- Tier 3: $50,000 - $99,999→ earn $125 in ETH

- Tier 4: $100,000 - $499,999 → earn $200 in ETH

- Tier 5: Trade over $500,000 → earn $750 in ETH

For example, if a user trades between $20,000 and $49,999 on CoinList.co or CoinList Pro, they will earn an additional Tier 2 bonus of $50. Bonuses will be distributed within 7 days following the campaign period. There is a maximum of one bonus per user. Trading qualifications are dependent upon geographical and regulatory restrictions. Terms subject to change.

Eligibility:

In order to be eligible for the referral bonus, users must be in one of CoinList Market's approved jurisdictions. Please see coinlist.co/legal for more details on approved jurisdictions.

Additionally:

- User must have participated in the NuCypher WorkLock on CoinList.

- User must complete KYC on CoinList and have an eligible wallet.

- User may trade on CoinList.co or CoinList Pro.

- Only one deposit bonus may be applied per CoinList account.

- Only one entity per user is eligible.

- CoinList employees and contractors are not eligible.

- User must trade during the campaign period (1.11.2021 - 1.31.2021).

- CoinList reserves the right to withhold bonuses to any user for any reason at its sole discretion.

Period:

Bonuses will be assigned on a first-come, first-serve basis during the campaign period: January 11, 2021 (1.11.2021) and January 31, 2021 (1.31.2021).

Reward Distribution:

For each eligible user, CoinList will deposit ETH into that user’s CoinList Wallet subject to eligibility. Bonuses will be distributed 7 days following the campaign period. The exact amount of ETH will be calculated at the market price of ETH at the time of distribution. Bonuses may not be the exact dollar amount due to ether’s market price fluctuations.

Additional Terms & Conditions:

You agree to be bound by the preceding rules (these “Rules”) and the CoinList Terms and Conditions, found here, by participating in this Trading Bonus Program. CoinList Markets does not guarantee any payment pursuant to these Rules. CoinList Markets reserves the right to change these Rules or cancel this Trading Bonus Program at any time in its sole and absolute discretion. CoinList Markets also reserves the right to render a user ineligible for participation in this referral program should it hold, in its sole discretion, that the user has engaged in any fraudulent, deceptive, abusive or unlawful behavior, including but not limited to Prohibited Use or Prohibited Businesses as those terms are defined in the Terms of Service, found here.

Trade on CoinList »

How do I earn staking rewards on CoinList?

When you deposit or purchase a supported Proof-of-Stake (PoS) asset on CoinList, you may be eligible to receive staking rewards by having that asset in your CoinList wallet.

Once you deposit an eligible asset into your CoinList wallet, you are automatically opted into staking rewards. There is no action on your end required to participate, but you may opt-out of staking rewards at anytime from the Staking page > Select the asset > Select “…” for more options > Toggle “Auto stake assets” off.

Information on AXL and WAXL Staking CoinList

1. What is AXL / WAXL staking?

Axelar is a proof-of-stake network that securely connects all blockchain ecosystems, applications, assets, and users to deliver Web3 interoperability. The AXL token is the utility token for the network, which supports security, decentralization, and ecosystem growth.

Axelar network security is based on delegated proof-of-stake. Axelar built permissionless technology that enables a path toward decentralization. AXL staking supports decentralization while allowing validators (and users who want to act as validators) to earn rewards.

2. What are the types of staking we offer for AXL and WAXL and how do I participate?

We offer auto-staking for both AXL and WAXL. To stake on CoinList, deposit AXL or WAXL into your CoinList Wallet and elect to stake them.

3. How much are AXL and WAXL staking rewards?

You can find the most current staking reward amount on the Staking page (https://coinlist.co/staking) of your account. Please note that CoinList does not guarantee any reward will accrue, and the amount of the reward is subject to change at any time. The estimated reward takes into account CoinList’s fee.

4. What fees are charged for this staking service?

A 15% fee will be taken from your earned staking rewards. Your staked principal will not be affected by the fee.

6. Do I have to buy AXL or WAXL on CoinList to earn staking rewards?

No. Users who have purchased AXL from other exchanges can deposit AXL into a CoinList Wallet and automatically enroll in the staking rewards program.

7. Who is eligible to earn AXL or WAXL staking rewards on CoinList?

AXL and WAXL staking is available in jurisdictions where AXL/WAXL is available for trading. Please visit this page to see our list of approved jurisdictions.

8. What are AXL or WAXL staking rewards paid out in?

If you stake AXL, rewards are paid out in the native version of the AXL token. If you stake WAXL, rewards are paid out in WAXL token.

9. When will I receive my AXL or WAXL staking rewards?

Rewards are distributed monthly.

10. Will my rewards be automatically re-staked? Are AXL rewards compounding?

Yes, your AXL or WAXL staking rewards are automatically re-staked and will earn additional rewards until you choose to trade or withdraw them.

11. Who are the AXL staking providers for CoinList?

Currently, AXL tokens held in CoinList Wallets are delegated to nodes operated by Everstake, Figment, BisonTrails, Forest Staking, and P2P Staking.

12. Can I choose the nodes my AXL tokens are delegated to?

CoinList does not include the functionality to choose the staking provider to which your tokens are delegated (i.e. they are automatically delegated to one of the providers listed above).

13. How do I opt out of AXL or WAXL staking rewards?

You will automatically receive staking rewards by holding AXL or WAXL in your CoinList Wallet. If you would like to opt-out of staking rewards, go to the Staking page > Select AXL > Select “…” for more options > Toggle “Auto stake assets” off. Please note that if you opt out of staking, your earned staking rewards will be distributed at the end of the month along with the regular staking reward distributions. You will not receive your earned staking rewards early.

14. Can I stake WAXL tokens?

Yes.

What is staking?

Some crypto networks, like Bitcoin, use a Proof of Work (PoW) consensus mechanism where miners validate transactions by solving difficult math problems, other networks use a consensus mechanism known as Proof of Stake (PoS). In PoW networks, miners maintain consensus and secure the network, while PoS networks rely on participants known as validators to perform the same work.

Validators confirm transactions and maintain consensus on the network to maintain the integrity and security of the blockchain they’re validating. To ensure that validators are acting honestly, PoS networks require validators to stake a minimum amount of tokens native to that network. This stake can be aggregated from many users, not just the validator, and essentially acts as a security deposit – if a validator is confirming invalid transactions, then validators will lose part of the capital they staked. As compensation for their work and for the opportunity cost of capital, validators earn network rewards for their work. These rewards can be shared among their community for users who have provided additional stake.

Most PoS networks have different and unique consensus mechanisms and economic models. We recommend conducting your own research on each network before participating in any staking program.

How to opt-out of staking rewards

If you would like to opt-out of staking rewards for autostaked assets, follow the below steps.

1. Select Staking from within the navigation panel of your account.

2. Select the asset you would like to opt-out of.

3. Select “…” for more options.

4. Toggle “Auto stake assets” off.

Information on SUI Staking

1. Who is eligible for SUI Trading and Staking?

SUI trading and staking is prohibited for residents in the U.S. including all U.S. territories, Canada, and other unsupported jurisdictions.

2. How does SUI Staking work?

When you deposit or purchase SUI on CoinList, you may be eligible to receive staking rewards by keeping SUI in your CoinList Wallet. Once you deposit SUI into your CoinList Wallet, you are automatically opted into staking rewards. There is no action on your end required to participate. Please note that SUI held on CoinList Pro does not earn staking rewards.

4. What fees are charged for this staking service?

A 15% fee will be taken from your earned staking rewards. Your staked principal will not be affected by the fee. You can find updated information about the fees here.

5. Do I have to buy my SUI on CoinList to earn staking rewards?

No. Users who have purchased SUI from other exchanges can deposit SUI into a CoinList Wallet and enroll in the staking rewards program.

6. How much are SUI staking rewards?

Rewards are determined on the protocol level. You can see current staking rewards at https://coinlist.co/staking. The estimated reward takes into account CoinList’s fee.

7. Who is the SUI staking provider for CoinList?

SUI tokens held in CoinList Wallets are delegated to nodes operated by Everstake.

Stake SUI » https://coinlist.co/staking

Mystiko (XZK) Rewards Sweepstakes

1. Promotion Period: The Promotion Period begins on June 18 10:00 UTC and ends July 2, 23:59 UTC. Following the completion of the Promotion Period, no further entries or trading activities will be considered.

2. Terms & eligibility:

- Users must complete KYC on CoinList and have an eligible wallet.

- You may earn up to 1 entry for every purchase of USD$100 XZK or more on CoinList. Limit of twenty (20) entries per user throughout the Promotion Period.

- Only one entity per user is eligible.

- Not available for residents of the United States. Users must be in one of CoinList’s approved jurisdictions. Please see coinlist.co/legal for more details on approved jurisdictions.

- CoinList reserves the right to withhold rewards to any user for any reason at its sole discretion.

- CoinList employees and contractors are not eligible.

- Market makers are not eligible.

3. How to enter:

Sign into your CoinList account

Purchase $100 worth of XZK (based on the value of the crypto asset(s) at the time the trade is accepted) on CoinList to earn one (1) entry into the sweepstakes.

4. Entry limit

There is a limit of twenty (20) entries per user throughout the Promotion Period. Entries received from any person who attempts to cancel and create a new account, or who attempts to create an additional account, during the Promotion Period will be disqualified. Any attempt by any Entrant to obtain more than the stated number of entries by using multiple/different email addresses or any other method will void that Entrant's entries and that entrant may be disqualified. Use of any automated system to participate is prohibited and will result in disqualification.

5. Random drawing: Twenty six (26) Potential Winners will be randomly drawn on or around July 16, 2024 from all eligible entries received. The random drawing will be conducted by CoinList, whose decisions are final and binding. The odds of winning a prize depend upon factors which include the number of eligible entries received.

6. Potential winner notification: Potential Winners will be contacted via email to the email address associated with their CoinList account. Rewards will be deposited to the Winners on or around July 16, 2024.

7. Prizes and prize restrictions:

Tier 1: One (1) winner will receive five thousand dollars ($5,000) in XZK. Total value of prize: $5,000

Tier 2: Five (5) winners will each receive two thousand dollars ($2,000) in XZK. Total value of prize: $10,00

Tier 3: Twenty (20) winners will each receive two hundred dollars and fifty ($250) in XZK. Total value of prize: $5,000

All prize values stated herein are in USD. Price of XZK prizes determined by CoinList’s set rate on a date and time selected by CoinList at its discretion prior to upload of prize to winner’s CoinList account. All winners who wish to sell the prize may do so by selling their XZK for any other asset available on CoinList.

Karma

What is Karma?

Karma is a point system that rewards you for your activities on CoinList. Karma increases your chance of getting into Token Launches and exclusive offers when you contribute to crypto protocols. Earn for doing good for crypto!

Our Karma program continues to evolve and as it does, we will provide additional information. CoinList retains the right to modify the terms of the Karma program at any time.

How do I claim my Legacy Karma?

Your Legacy Karma is all the Karma you earned from the legacy Karma system. You will need to claim your Legacy Karma in order to transfer it to the new system.

You can claim this Karma by logging in and going to the Karma page here. You will then see a claim available for "Legacy Karma" that has all the Karma you've earned from the legacy system. Simply claim and watch your Karma Score increase. Unclaimed Legacy Karma will expire May 15 at 23:59 UTC.

In case you're unable to claim, logging out of your CoinList account and logging back in should resolve the issue. If you still need further assistance, open a ticket with our support here.

What are Tiers?

Your Karma Score compared to other Karma earners places you in one of five Tiers: Rust, Bronze, Silver, Gold, Platinum.

Each Tier has a certain percentile of users, with Rust Tier being the bottom 40% of earners, and Platinum Tier being the top 5% of earners.

For Token Launches: Every single participant is randomly selected, but your Tier adds weight to the random selection. The higher your Tier, the higher the chance you get selected, though allocations are never guaranteed. For example, in one of our 2024 Token Launches, users in the Platinum Tier had 3x the chance to secure an allocation versus users in the Rust Tier.

How can I earn Karma?

You can earn Karma from Events and Achievements.

Events are activities that you can earn Karma from over a specified period of time. The Karma you earned during that event only becomes claimable once the event ends. If you don’t claim your Karma within 7 days after the event ends, this unclaimed Karma will expire.

Achievements are one-time claims awarded upon completing specific activities on CoinList, such as your first deposit, first trade, first stake, and more. Once an achievement is awarded, the Karma for that achievement becomes claimable.

Any Karma that you claim does not expire. Only unclaimed Karma may expire after a specified period of time.

See all the Events and Achievements you can earn Karma from today by logging into your Karma page here.

Why did I lose my Tier?

Tiers are updated hourly so the Tier you are placed in after claiming Karma may change quickly depending on how much Karma others have earned as well.

Remember, your Tier is determined by your Karma Score compared to other earners. The best way to keep your Tier and stay ahead, is to stay engaged and keep earning.

I did a specific activity (eg: a trade) and my achievement is still not claimable?

In general, once you complete an activity that earns you Karma (eg: enabling 2FA, making a trade, etc.), that activity should be taken into account by the Karma system within a few seconds. If you are still unable to claim Karma from that activity after 30 minutes, please open a customer support ticket here.

Wallets

How long do ether transactions take?

CoinList waits for 30 confirmations to consider an ETH or ERC-20 transaction final. Although typically this should only take about ~ 5 minutes, this can take anywhere from 5 minutes to 4 hours. Especially during periods of high network congestion, the transaction can take longer. You can see the number of confirmations in your CoinList wallet.

How long do Bitcoin transactions take?

Bitcoin transactions have hundreds to thousands of confirmations from their networks to confirm that they are real transactions. CoinList waits for 6 confirmations to consider the transaction - this can take anywhere from thirty minutes to twelve hours. During periods of high network congestion, transactions can take longer.

How do I fund my CoinList wallet?

You can deposit any supported assets into your CoinList account by following the steps below:

- Log into your CoinList account

- Visit https://coinlist.co/wallets

- Go to the wallet for the asset you’d like to deposit

- Click “Deposit”

- Copy and paste or Scan the QR code to obtain your CoinList wallet address

- Follow the instructions on the deposit page and initiate your transfer

You can find our supported assets and blockchains here. Make sure you are researching and familiar with the addresses you are using to deposit any cryptocurrency.

You can also fund your account using fiat. More Information can be found here.

Can I fund my wallet or investments using my online exchange wallet?

Yes.

For withdrawals, you should re-confirm the withdrawal address plus the network supported on both your 3rd party exchange wallet and CoinList prior to submitting a withdrawal. Exchanges have various policies for crypto deposits, and the sending addresses don't always match the receiving addresses. We recommend you designate a return address for which you hold the private keys. CoinList is not responsible for transfers being appropriately credited to your account at a 3rd party exchange. We advise you to double-check the warnings on both the exchange you are sending from and CoinList before making these transfers.

In the meantime, you can find our supported assets and blockchains here.

What's a wallet?

In general, a wallet is a program that enables users to send and receive digital currency and track their balances and transactions. They also store important security information: your public and private keys. There are several types of wallets: Hardware, Software, and Online. Hardware wallets store a user's private keys on a hardware device like a USB. Trezor and Ledger are popular hardware wallet brands. Software wallets run as an app on your phone or desktop. Online wallets run in the cloud and are accessible from any computer or smartphone in any location.

CoinList offers online wallets.

We also use the term "wallet" to describe your U.S. dollar account.

Are my funds secure in CoinList Wallets?

Yes! CoinList works with a number of highly vetted 3rd party custodians and wallet providers including Anchorage, Bitgo, Gemini Custody, Finoa, Copper, Coinbase Prime, and Fortress Trust to ensure the security of your assets.

Funds held in cold storage are covered under the insurance policies of our custodian partners. Please note, not all funds are held in cold storage at all times.

Withdraw Cryptocurrency

What To Know

Different exchanges have varying policies for crypto transfers, which you should review before initiating any transactions. Prior to submitting a withdrawal from your CoinList wallet, it is important to confirm the receiving wallet address.

Fees

CoinList does not charge additional fees for depositing or withdrawing crypto.

However, for withdrawals, the respective blockchain will charge gas/fees to process your transaction onchain. Please note that these fees are not paid to CoinList or the custodian.

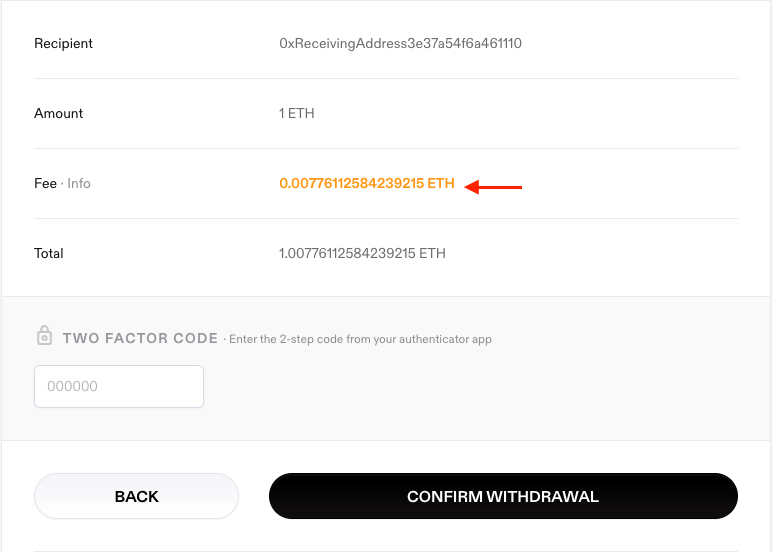

When withdrawing, after you click "Review", you will see the gas fee here:

The amount shown here is an estimate.

The actual network fee will vary and will be displayed in your withdrawal confirmation.

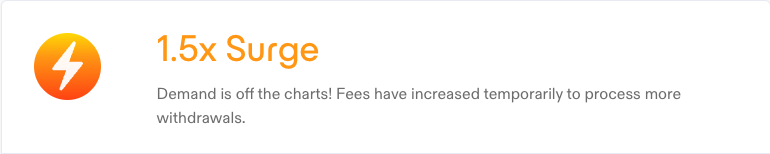

If withdrawal fees are increased during periods of high demand, this will be displayed above your withdrawal:

See our Fees and Limits page for more information: https://coinlist.co/fees.

Initiate a Crypto Withdrawal

- Select Wallets from within the navigation panel.

- Select the wallet for the asset you would like to withdraw.

- Click the “Withdraw” button.

- Paste the “Recipient Address” into the required field.

- Input the amount you would like to withdraw.

- Preview the withdrawal details.

- Initiate your transfer.

I transferred funds to/from the incorrect address. What do I do now?

Once you have confirmed a deposit to or withdrawal from your CoinList account, the transaction is initiated and sent to the blockchain. After withdrawals are initiated, the funds are no longer on CoinList's platform. Due to the nature of blockchains, these funds cannot be reversed or recovered by CoinList.

Transactions in virtual currency may be irreversible, and, accordingly, losses due to fraudulent or accidental transactions may not be recoverable. Please review the additional risks associated with investing in and sending cryptocurrencies by reading Risks of Investing in Virtual Currencies.

Supported Networks

CoinList currently only supports select networks. It is important to research the network you are using before placing a transfer. To see what networks CoinList supports, read our Supported Networks article.

Why have I not received my withdrawal?

Visit our Status Page to check for any ongoing maintenance, delays and updates.

Is your withdrawal a large amount?

There may be a checkpoint in place to manually verify and approve your transaction if your withdrawal is beyond $10,000 USD. This is a security safety feature in place to ensure you are withdrawing to the correct address because once a withdrawal has left CoinList we are unable to recover funds.

This will be reviewed within 24 business hours.

Once a transaction has been pushed on-chain you will receive your Transaction Hash. Using this you will be able to track and monitor the transaction entering your nominated receiving address.

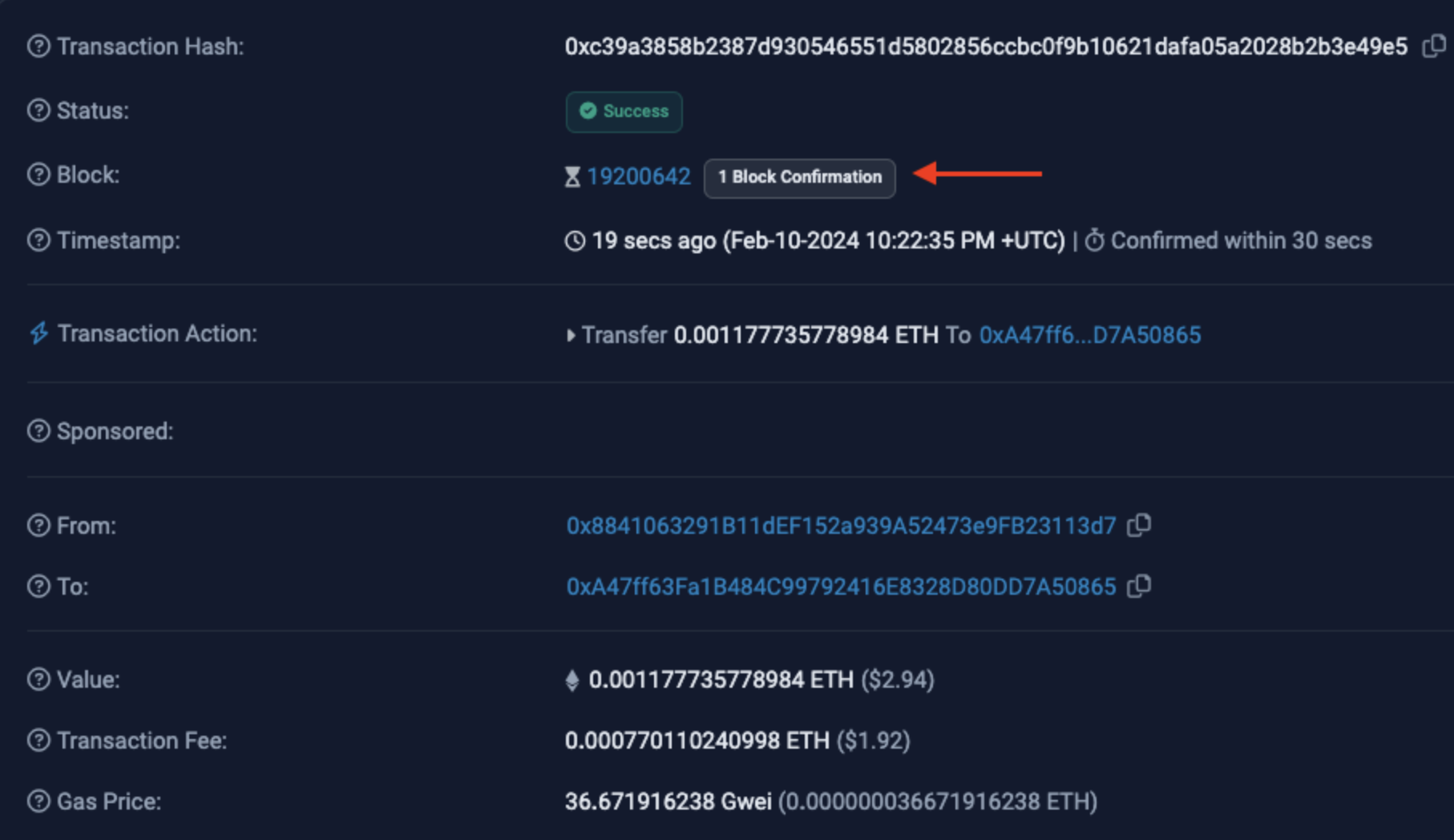

Each transfer will require a number of “confirmations” before the receiving address confirms the transfer as successful.

This may vary depending on the receiving wallet and token/blockchain used.

For example, on average;

- Bitcoin requires 6 confirmations, this can take anywhere from five minutes to four hours depending on Bitcoin network activity.

- Ethereum and ERC-20 tokens require 30 confirmations, which may take approximately five minutes. However, if the network is experiencing temporary congestion this may up to four hours or longer.

Where can I see the confirmations?

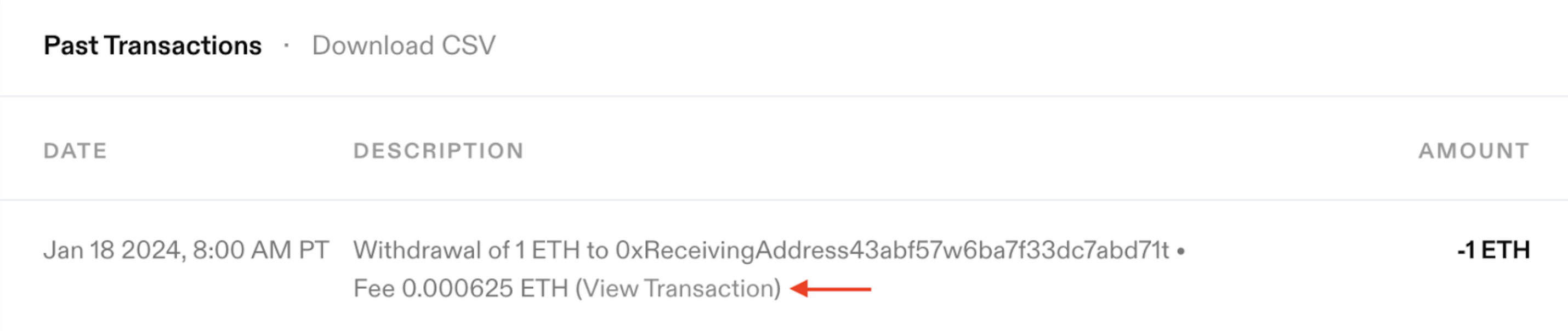

- By clicking “View Transaction” in your CoinList wallet you can monitor this from the block explorer. For example, a transaction on Ethereum using Etherscan:

If you’re continuing to have issues or have any questions, please raise a support ticket here.

Sending Funds to an Incorrect Address or Chain

Which blockchains and assets are supported by CoinList?

Ethereum (ERC20) | ETH, USDT, USDC, TUSD, TBTC, DAI, WBTC, MKR, PAX, OXT, LINK, MATIC, COMP, SKL, UNI, OCEAN, NU, NYM, IMX, BAL, RLY, WCFG, EFI, AAVE, CQT, HMT, EFIL, BZZ, VEGA, BTRST, CLV, WAXL, CYBER, FLIP, ONDO, ZETA, WLD, ENJ, MASA, TST, MSN, XZK, MOCA, CXT, KARATE, PEPE, SHIB, G, TRIBL, ENA, PLAY, MOG, ZKL, SPX, LBTC, weETH, wstETH, ETHFI, KING. |

Algorand | ALGO |

Agoric | BLD |

Bitcoin | BTC |

Celo | CELO, CUSD |

Centrifuge | CFG |

Casper | CSPR |

Dogecoin | DOGE |

Polkadot | DOT |

Filecoin | FIL |

Flow | FLOW |

Dfinity | ICP |

Mina | MINA |

Oasis | ROSE |

Sei | SEI |

Solana | NEON, SOL, NATIX, MOTHER, POPCAT, WIF, MEW, TRUMP, MELANIA, GIGA |

Stacks | STX |

Sui | SUI |

Tezos | XTZ |

Avalanche (C-Chain) | AVAX |

Axelar | AXL |

Polygon | BCUT, |

Artbitrum | SQD |

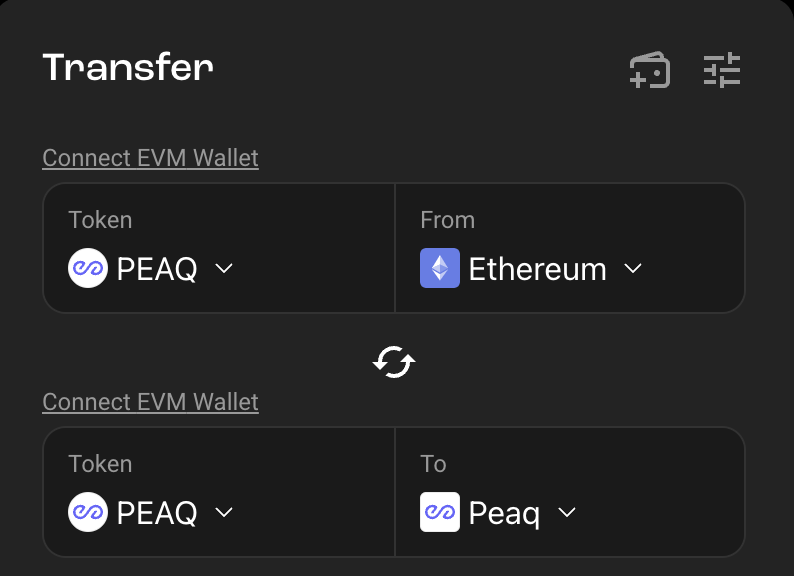

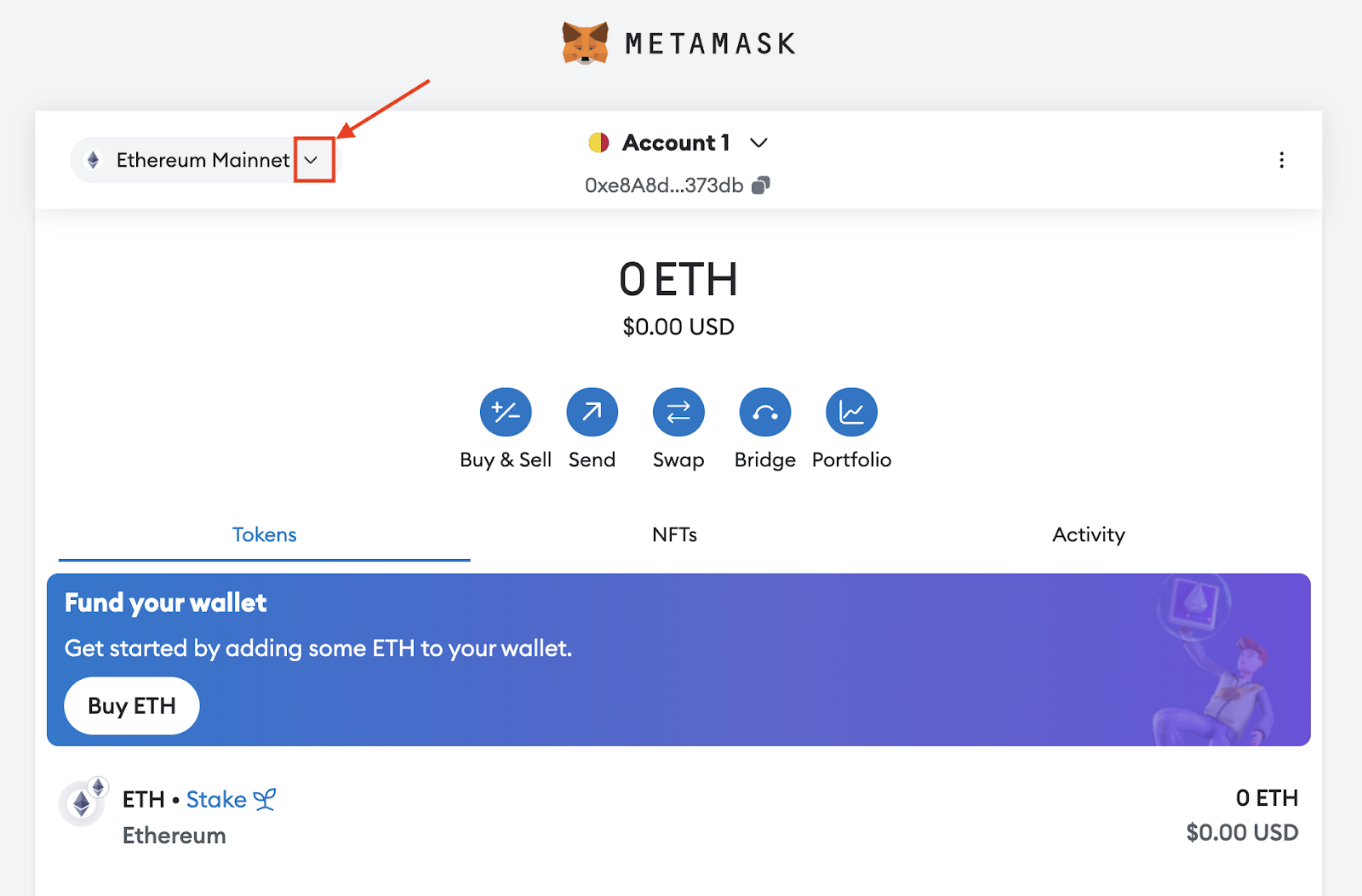

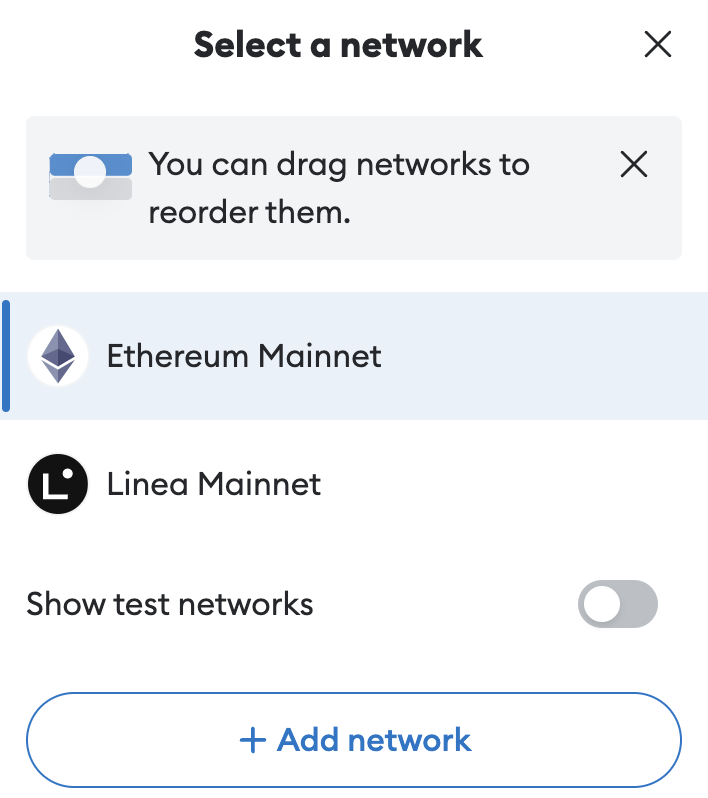

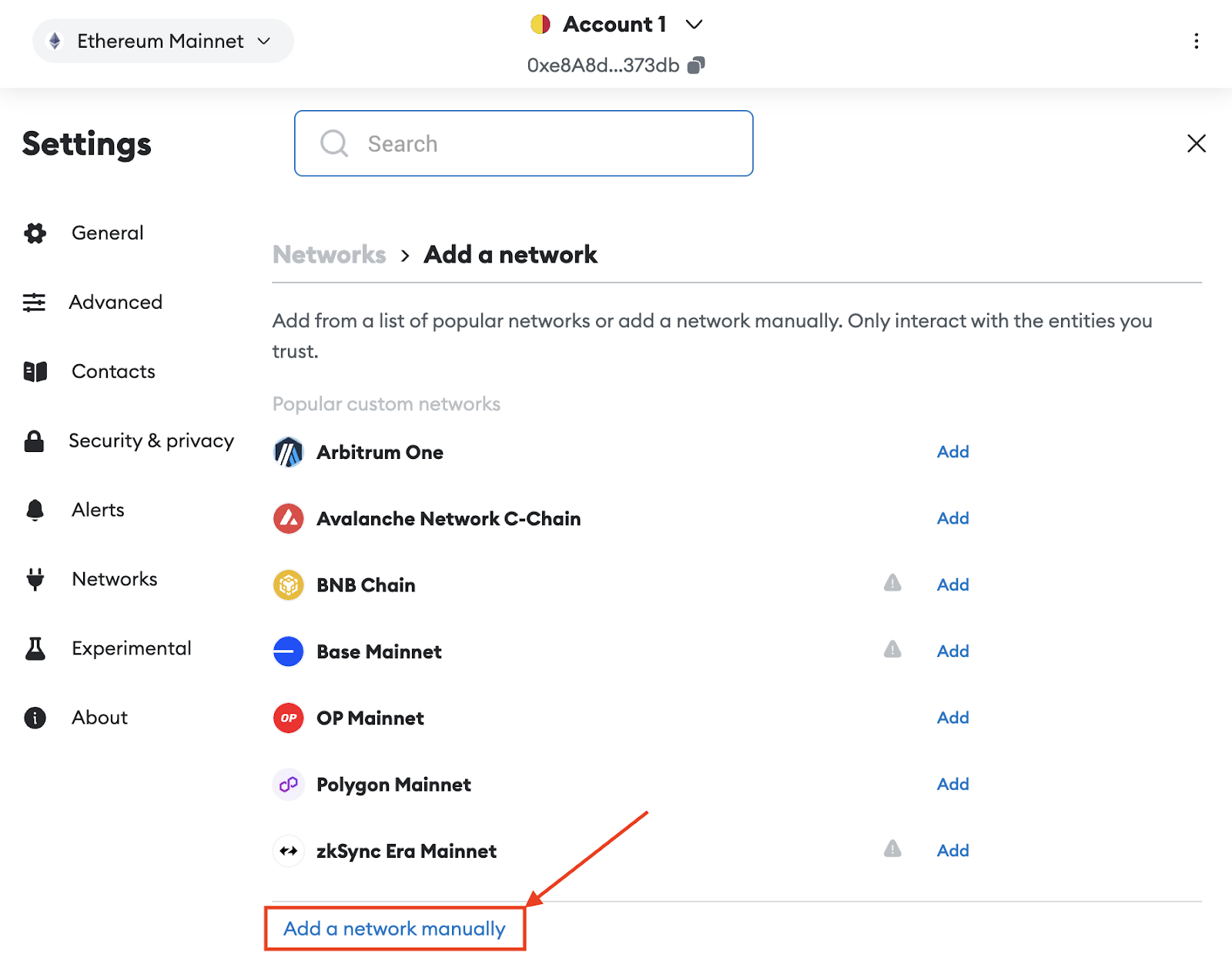

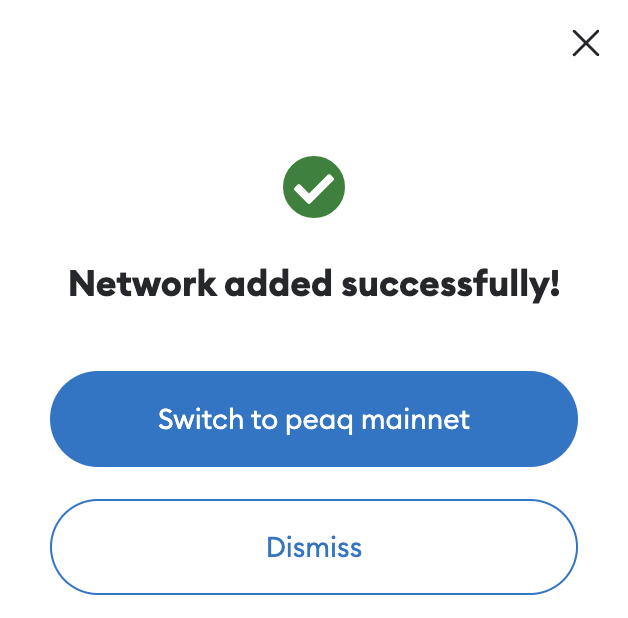

| Peaq | PEAQ |

| Nillion | NIL |

| Optimism EVM | WCT |

Do not send funds in to CoinList via any other chain that is not supported, such as BEP20 or TRC20. If you do this you risk losing your funds.

Can my funds be recovered if I send tokens from an unsupported network?

We may be unable to perform a recovery of funds sent via the incorrect network. If we are able to recover the funds, there will be a charged fee. Please see our fee page for more information.

Please do not trust previous transactions you have made as a source for your deposit address. CoinList and other exchanges may update and change the receiving address on your account after it has been used.

Withdrew funds to the incorrect address?

Once you have confirmed a withdrawal from your CoinList account the transaction is initiated and sent to the blockchain, after this the funds are no longer on CoinList's platform. Due to the nature of blockchain these funds cannot be reversed or recovered by CoinList. If you know the end user of the address, please try and contact them for help retrieving funds.

Transactions in virtual currency may be irreversible, and, accordingly, losses due to fraudulent or accidental transactions may not be recoverable. Please see the additional risks associated to investing in and sending cryptocurrencies here.

Memo ID

CSPR deposits require a number called the "tag," "memo," or "transfer ID" to be sent with your deposit in order for funds to be credited to your account. If you deposit CSPR without it, your deposit will be lost and cannot be reclaimed.

STX and SEI deposits also require a memo ID. It may be referred to as a "memo" or "tag" on other exchanges. Only deposit using wallets that support this field. If in doubt, start with a small test deposit.

Trading

How do I redeem Wrapped Bitcoin (WBTC) for BTC?

To unwrap WBTC into BTC, you first need to have WBTC in your CoinList wallet. Once your wallet is funded with WBTC:

- Click “Unwrap” from inside your WBTC wallet.

- Enter the amount of WBTC you wish to swap into BTC

- Click “Confirm Unwrap” to receive BTC directly in your BTC wallet.

WBTC will be debited from your WBTC wallet and you will receive BTC in your BTC wallet.

Please note that you will have two different wallets. You will not receive BTC in your WBTC wallet.

What is Wrapped Bitcoin (WBTC)?

Wrapped Bitcoin (WBTC) is an ERC-20 token backed 1:1 by Bitcoin and held at Bitgo Trust, and the underlying holdings are verifiable here. WBTC brings the liquidity of Bitcoin to the Ethereum ecosystem.

Users can wrap and unwrap BTC seamlessly via their CoinList wallet.

What are the fees?

You can find the most up to date information on trading fees here.

How long does it take to wrap and unwrap BTC?

A CoinList affiliate manages its own pool of BTC and WBTC, so the process is usually immediate. When demand is high, it is possible that the pool temporarily runs out of BTC or WBTC. If that is the case, the wrapping or unwrapping service will pause until the pool is replenished.

You may choose to hold your funds to be automatically converted when the pool is replenished. This situation is usually addressed within (6) to twenty-four (24) hours.

How do I make a trade?

When you're logged in, click on Trade in the left navigation.

Once you see the trading screen. You will then be prompted to enter an amount of a specific cryptocurrency you wish to buy or sell. Once you have set the amount, you can preview the order.

After selecting “preview order”, you will be presented with the price for your order. You will have 30 seconds to confirm the trade. If you do not confirm the trade within 30 seconds, you will be required to re-input your order. The price may change after the 30 second window. Once you confirm the order, the trade will be considered final and it will be executed, you will see the resulting balances in your applicable CoinList Wallets.

Are there minimum or maximum order sizes?

Yes, you can find the most up to date minimum and maximum trade limits here https://coinlist.co/legal

What are the fees to Wrap and Unwrap WBTC?

For information about the fees for Wrapping and Unwrapping WBTC, see our fee page here.

How do I get Wrapped Bitcoin (WBTC)?

To obtain WBTC, you first need to have BTC in your CoinList wallet. You can either directly deposit BTC in your wallet or you can buy BTC through CoinList. Once your wallet is funded with BTC:

- Click “Wrap” from inside your BTC wallet.

- Enter the amount of BTC you wish to convert into WBTC

- Click “Confirm Wrap” to process the transaction

BTC will be debited from your BTC wallet and you will receive WBTC in your WBTC wallet.

Please note that you will have two different wallets. You will not receive WBTC into your BTC wallet.

Are there minimum price increments for orders?

Yes, but these are not uniform across all assets, please see https://coinlist.co/legal for the most up to date information.

Do all users automatically have access to CoinList wallets & trading?

Depending on when you signed up for CoinList, you may need to complete additional compliance in order to use wallets and trading. You can complete your registration at https://coinlist.co/wallets/new. New users should automatically have access to wallets and trading, subject to additional jurisdiction restrictions.

How can I convert wrapped assets?

Our Conversion function allows you to wrap/unwrap various assets. To unwrap your assets, follow the steps below:

- Click on "Conversions" from the navigation panel

- Select the pair of asset and enter the amount that you would like to convert

- Click the "Review" button

- Review your conversion and click "Confirm"

Here are the assets we support for conversions: FIL -> EFIL, EFIL -> FIL, USDC->USD, USD->USDC, BTC->WBTC, WBTC->BTC, TBTC ->BTC, NU ->T, AXL ->WAXL, WAXL ->AXL, CFG -> WCFG, WCFG ->CFG

Managing my account

Lost access to my 2FA device

If you have lost access to your 2FA device, you can use one of your account backup codes that you were asked to save after setting up two-factor authentication. If you no longer have access to these backup codes or have used all of them, please submit a support ticket.

Do not attempt to create a new account. CoinList does not accept duplicate accounts. If you create a duplicate account, it will be closed and you will have to proceed with a 2FA reset on your original account. Attempting to create a second account is in violation of our Terms of Service; Any violation of the Terms of Service may result in indefinite suspension of services and closure of a user's account.

Multi-Factor Authentication (MFA/2FA)

What is Multi-Factor Authentication?

CoinList use Multi-Factor Authentication (MFA), also known as Two-Factor Authentication (2FA) for every account and most transactions, and we partner with top custodians like BitGo and Gemini Custody so your funds are safe. Funds held in cold storage are insured by our custodian partners' insurance policies. Best of all, crypto storage is free. We don’t charge any custody or wallet fees when using CoinList or the CoinList app.

How do I enable MFA?

In order to use CoinList wallets, you must set up device-based MFA. CoinList does not support SMS or phone-based MFA.

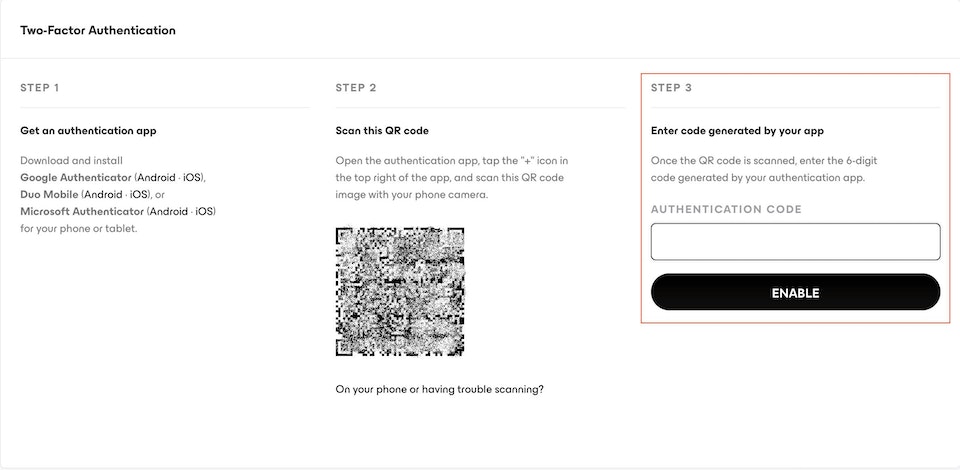

STEP 1

Download and install an authentication app for your phone or tablet. Some options:

- Google Authenticator (Android · iOS)

- Duo Mobile (Android · iOS)

- Microsoft Authenticator (Android · iOS)

STEP 2

Open the authentication app and follow the steps within the app for adding a new QR code. Scan the QR code image with your mobile device's camera and a new credential will be added to your authenticator app.

Make sure to save the security/backup codes in a safe place. In the event that you lose access to your MFA device, these codes can be used to regain access to your account. The backup codes are unique to each account owner.

STEP 3

Enter the six digit code where prompted and click the "Enable" button.

You are done! Now that MFA is enabled, you will need to enter a new 6-digit code generated by the authentication app every time you log in to your CoinList account.

What if I get an invalid code error?

If you receive an invalid error code when enabling MFA, check that your authentication app and your mobile device’s current time zone are synced. Also ensure that the computer or device you’re setting up your CoinList account on is also synced to the correct time zone. Refreshing your CoinList account may also resolve the issue.

If you are still experiencing issues, create a new profile by clicking the "+" again on your app and try to add the QR code again. Clearing your cache and cookies may also resolve the issue.

Security Page of Your CoinList Account

You can reach the Security page by selecting “Your Account” from the dashboard or by following this link: https://coinlist.co/accounts/security.

If you did not save your backup codes when they were first provided, you can access them through the Security page of your CoinList account. If you lose access to your MFA device, these one-time codes will allow you to regain access to your account.

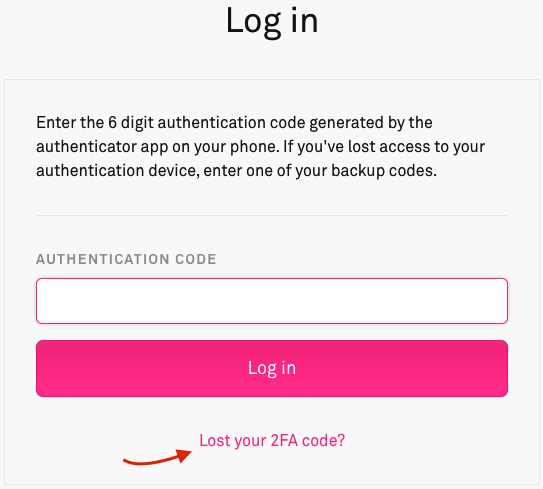

What if I no longer have access to my MFA device or the backup codes?

If you no longer have access to your MFA device, you may be able to go through our automatic and fast-lane 2FA review process by selecting "Lost your 2FA code?" after logging in here: https://coinlist.co/login.

If you do not see this, please submit a support ticket here: https://coinlist.freshdesk.com/en/support/tickets/new for assistance and instructions. You will not be able to access your account until this process is complete.

If you have lost access to your MFA device, do not attempt to create a new account. CoinList does not accept duplicate accounts. If you create a duplicate account, it will be closed and you will have to proceed with a MFA reset on your original account.

Attempting to create a second account is in violation of our Terms of Service; Any violation of the Terms of Service may result in indefinite suspension of services and closure of a user's account.

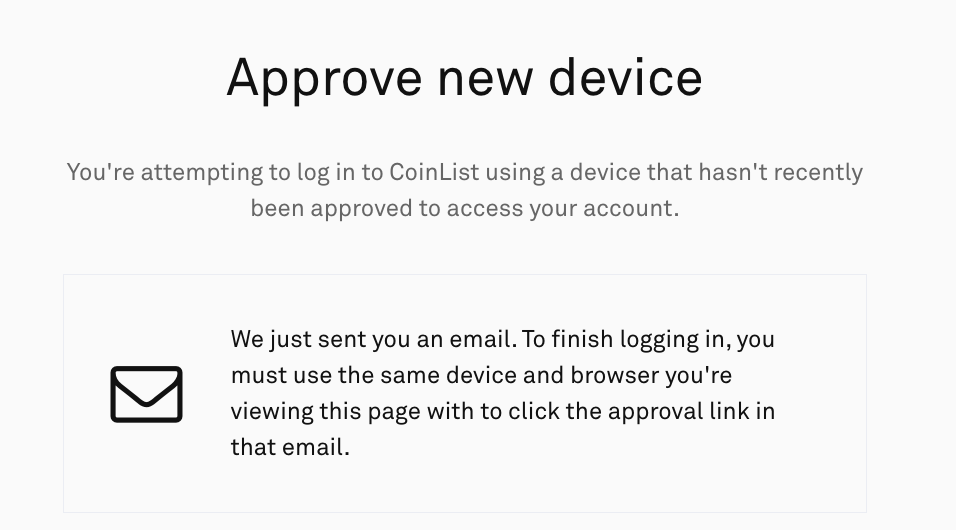

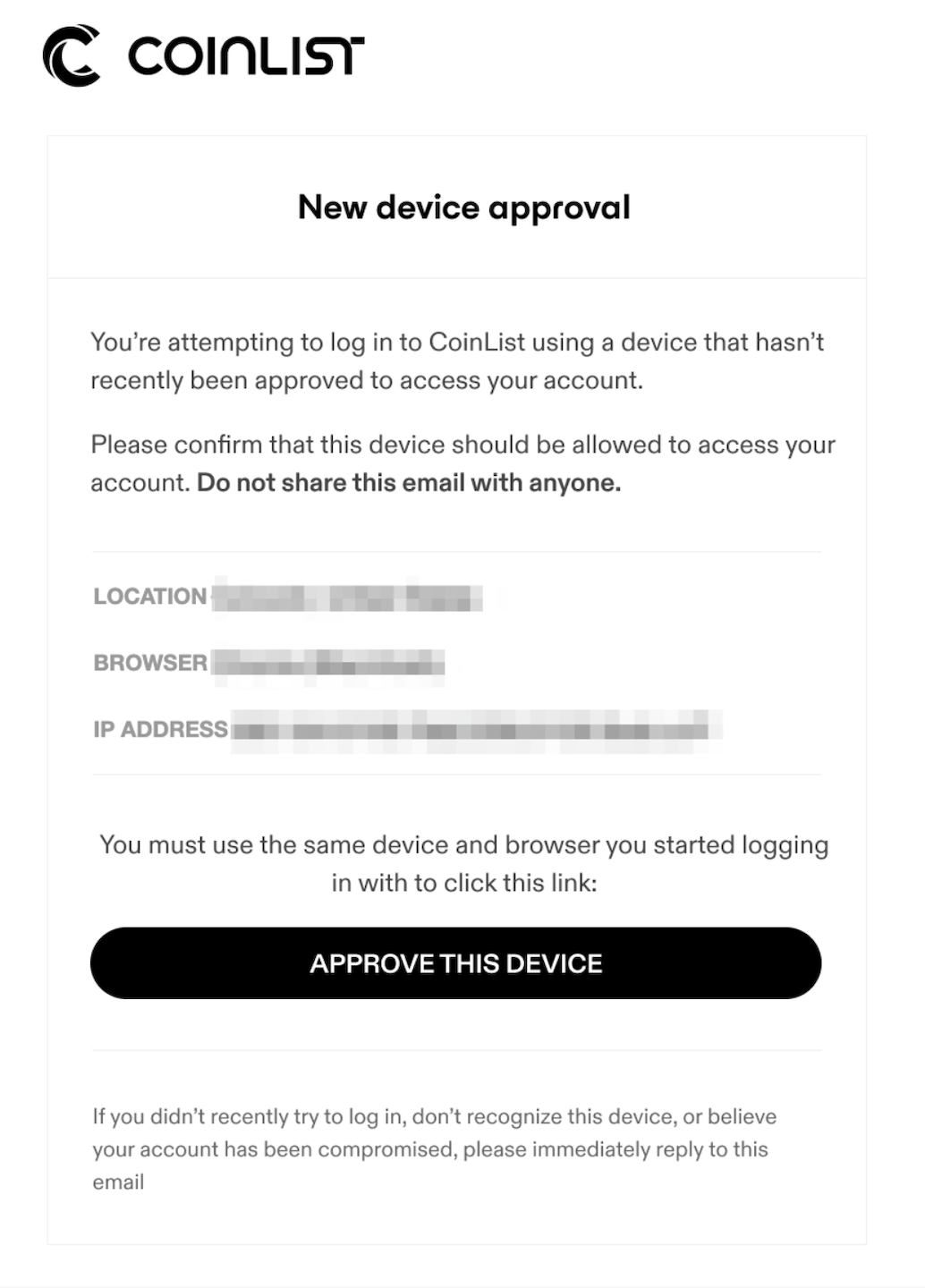

New Device Approval

Approve a New Device

CoinList requires that you approve a new device before you can access your account.

- You will also be prompted to reapprove your device if you:

- Clear the cache and cookies from your browser,

- Are using your browser's "private browsing" or "incognito" mode,

- Are using a VPN service or encrypted network,

- Log in to the CoinList app.

To approve a device, start by logging into your account and entering your 6-digit authentication code. You will then be directed to a page informing you that CoinList has sent you an email. Access that email with the subject line “Approve your new device to log in” on the same device and browser. Click the Approve this device button in the email and you will be directed to your account.

This approval process must be started and completed on the same device, same browser, and at the same location.

It may take up to 10 minutes to receive this email. If you attempt to log in again, you may receive more than one email. Only the most recent new device approval email will be valid. If you do not receive the email, check your spam and other subfolders. You can whitelist emails from CoinList (team@coinlist.co) to prevent them from being flagged in the future.

You can watch the New Device Approval process here.

Step By Step Instructions to Approve a New Device

When you log into your CoinList account from a new device, you will be prompted to follow these steps.

Step 1

Log in to your CoinList account and enter your 6-digit authentication code.

Step 2

You will be directed to an “Approve new device” page informing you that CoinList has sent you an email.

Step 3

Access this email from the same device, browser, and location. Upon opening the email, click the “Approve this device” button at the bottom.

Step 4

You will be directed to your account where you are now logged in.

Trouble Approving a New Device

Troubleshooting Steps for the CoinList App

We currently recommend accessing your CoinList account through a web browser instead of the app. Nonetheless, if you are logging into the CoinList app using your phone or tablet, the “Approve this device” button in the email may open a browser instead of the CoinList app. This prevents the app from approving the device. Here are a few workarounds:

- Try long-pressing the link. Your email may display an option for you to "open link" in the CoinList app.

- Make sure you are using the most recent "New device approval" email that is sent to you after your login attempt.

If that doesn't work, follow the steps below specific to your type of device.

For iOS, copy the link from the email you received and paste it into a new Safari browser.

For Android:

- Go to your phone settings.

- Search for "opening links".

- Find "CoinList" under Installed Apps.

- Select "allow app to open supported links" or "ask every time".

Additional Troubleshooting

If you did not receive the “New device approval” email, check your spam and other subfolders. You may whitelist emails from CoinList to prevent them from being flagged in the future.

After clicking the “Approve this device” button, wait at least 10 minutes to receive the approval email before clicking the button again. Only the most recent device approval email will be valid.

If you are having issues with device approval, do not create a new account. Attempting to create a second account is in violation of our Terms of Service. Any violation of the Terms of Service may result in an indefinite suspension of services and closure of a user's account.

If you're still having trouble approving a new device, please submit a support ticket.

Compliance

What are the risks of purchasing virtual currencies?

- virtual currency is not legal tender, is not backed by the government, and accounts and value balances are not subject to Federal Deposit Insurance Corporation or Securities Investor Protection Corporation protections;

- legislative and regulatory changes or actions at the state, federal, or international level may adversely affect the use, transfer, exchange, and value of virtual currency;

- transactions in virtual currency may be irreversible, and, accordingly, losses due to fraudulent or accidental transactions may not be recoverable;

- some virtual currency transactions shall be deemed to be made when recorded on a public ledger, which is not necessarily the date or time that the customer initiates the transaction;

- the value of virtual currency may be derived from the continued willingness of market participants to exchange fiat currency for virtual currency, which may result in the potential for permanent and total loss of value of a particular virtual currency should the market for that virtual currency disappear;

- there is no assurance that a person who accepts a virtual currency as payment today will continue to do so in the future;

- the volatility and unpredictability of the price of virtual currency relative to fiat currency may result in significant loss over a short period of time;

- the nature of virtual currency may lead to an increased risk of fraud or cyber attack;

- the nature of virtual currency means that any technological difficulties experienced by the licensee may prevent the access or use of a customer’s virtual currency; and

- any bond or trust account maintained by the licensee for the benefit of its customers may not be sufficient to cover all losses incurred by customers.

What is a private banking account?

A “private banking” account is an account (or any combination of accounts) that requires a minimum aggregate deposit of $1,000,000, is established for one or more individuals and is assigned to or administered or managed by, in whole or in part, an officer, employee or agent of a financial institution acting as a liaison between the financial institution and the direct or beneficial owner of the account.

What is KYC?

KYC stands for Know Your Customer and encompasses certain procedures that we employ to positively identify that you are, who you say you are. We use a number of tools to confirm your identity and ensure your eligibility for the CoinList services. This process can take between 0-3 business days for individuals, and for entities and trusts this can take up a week.

You may be restricted from certain activities on the CoinList platform until you have completed identity verification.

What is a foreign financial institution?

A foreign financial institution is:

(1) a non-U.S. bank;

(2) any branch or office located outside the United States of a broker-dealer; futures commission merchant or introducing broker; or open-end mutual fund company;

(3) any other person organized under foreign law (other than a branch or office of such person in the United States) that, if it were located in the United States, would be a broker-dealer; futures commission merchant or introducing broker; or open-end mutual fund company; and

(4) any person organized under foreign law (other than a branch or office of such person in the United States) that is engaged in the business of and is readily identifiable as: (a) a currency dealer or exchanger; or (b) a money transmitter.

What is a foreign shell bank?

Foreign shell banks are non-U.S. banks without a physical presence in any country. A "foreign bank" is any bank organized under non-U.S. law or an agency, branch or office of a bank located outside the U.S. The term does not include an agent, agency, branch or office within the U.S. of a bank organized under foreign law.

Why can't I access this page?

CoinList prides itself on offering compliant products and services. As part of our compliance program, we determine which users are able to access information about our offerings.

We have determined that, due to regulatory uncertainty or restrictions, users in your location are not able to access the page you were attempting to reach.

Who can use wallets? Who can buy and sell cryptocurrencies?

Subject to regulatory restrictions, anyone can use wallets, and anyone can buy and sell cryptocurrencies. There is no accreditation requirement. Users must complete KYC and identity verification.

You can see a full list of supported jurisdictions here.

General

Can non-US residents use CoinList?

Non-US investors can invest and trade on CoinList as long as they meet local laws regarding investment compliance. Please visit coinlist.co/legal for more information and visit our Help Center for any questions.

Pro Trading

Account Management

Enabling and Disabling One-Click Trading

CoinList Pro allows you to choose between submitting orders with a single-click or receiving a notification containing your order details which must be affirmed in order to submit the order into the market.

To manage your order notification settings, click on the dropdown menu in the upper right of the platform, select Account Settings, choose My Preferences, and then enable or disable notifications by using the control next to “Display confirmation dialog before placing trades.”

Note: disabling order notifications will result in orders being submitted immediately into the market upon placement. Please exercise caution when utilizing one-click trading.

Manage Order Status Updates

CoinList Pro allows you to control the amount of order status update messages that you receive.

To manage your order status updates, click on the dropdown menu in the upper right of the platform, select Account Settings, choose My Preferences, and then enable or disable notifications by using the control next to “Display notifications for order status updates.”

Getting Started

Create an account

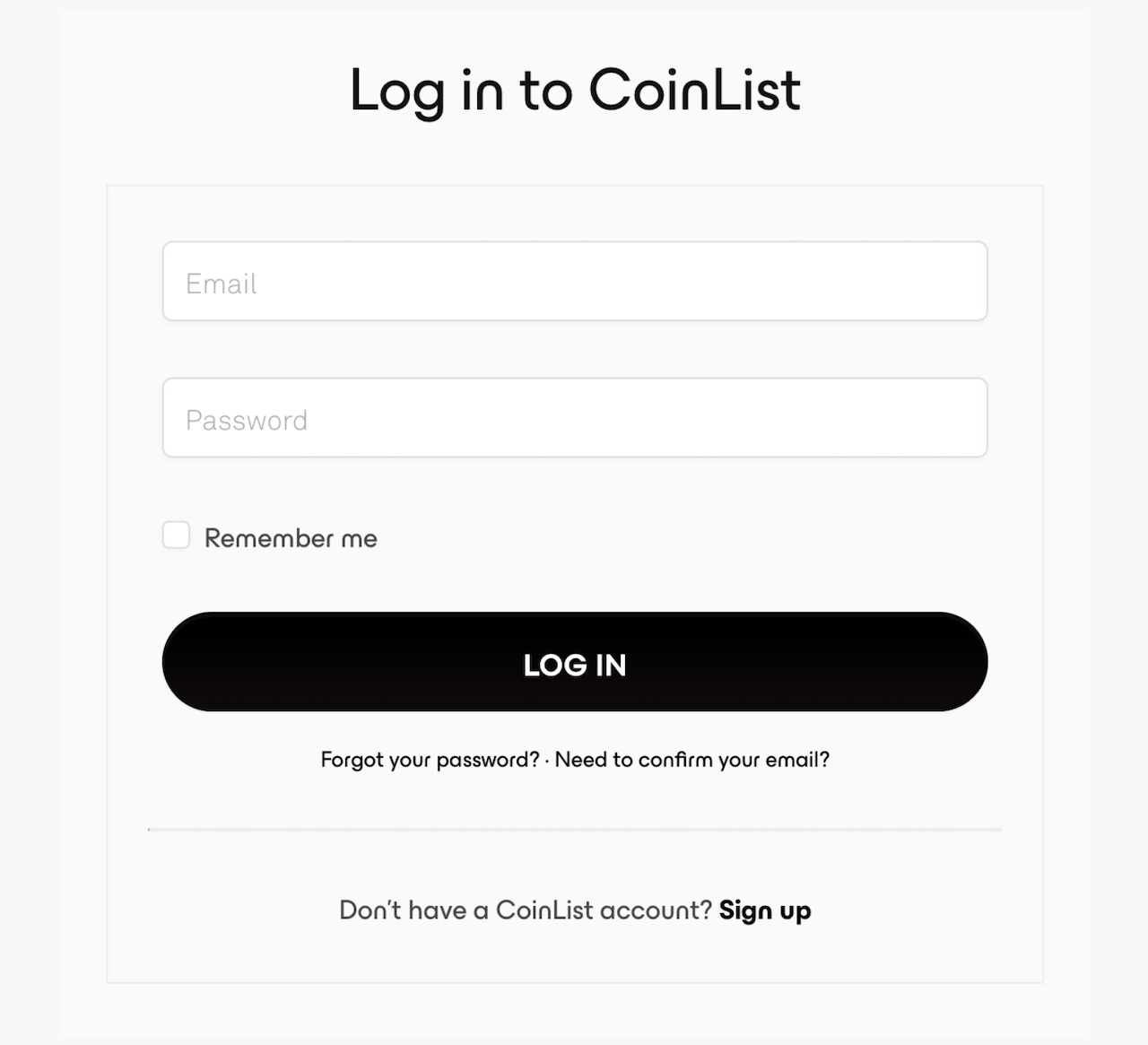

- Visit https://coinlist.co/register

- Enter in your first name, last name, and email

- Create your password

- Your password is required to have a minimum of 10 characters

- Verify your email

Open up your wallet

- Visit https://coinlist.co/wallets/new

- Choose your entity type

For individuals, we require:

- Name

- Country + state of residence

- Address

- Date of birth

- SSN (USA only)

- Phone number

- Selfie

- Photo of government-issued ID

- Occupation

For companies, we require:

- Name of entity

- Country + state of residence of the entity

- Company type

- Tax ID number (US only)

- Incorporation date

- Incorporation location

- Company address

- Information on major shareholders (any individual or entity that owns 25%+)

- Documentation attesting to major shareholder ownership

- Information on the signatory for the company

- Selfie of the signatory

- Photo of government-issued ID for the signatory

- Signatory’s occupation

Once you’ve provided that information, the last step is to set up 2FA for your account. We recommend using common 2FA applications like Google Authenticator, Duo, or using an Yubikey.

API

Creating an API Key

In order to access CoinList Pro’s API, you will need to generate an API key and secret. API keys represent read, write, and/or fund transfer entitlements on a specific CoinList entity's trading account.

To get your unique API key, click on the dropdown menu in the upper right of the CoinList Pro platform, select API, and then click Create New Key.

Accessing API Documentation

Here is the direct link to CoinList Pro’s API documentation.

To access CoinList Pro's API documentation from the trading platform, click on the dropdown menu in the upper right of the platform, select API, and then click API Documentation.

Canceling Orders

CoinList Pro’s order book supports canceling working orders when in trade mode.

You can cancel individual working orders or cancel all working orders quickly in CoinList Pro’s order module. To cancel individual orders, simply click the trash can icon next to the order you wish to cancel.

Placing Orders

Market orders refer to trades that are purchasing a given asset at the current market price (i.e. spot price) for the asset. You can place a market order by following these instructions:

- Choose the trading pair - click on the trading pair you want to use to trade

- Choose the order type - click on the order type you would like to use

- Enter the trade size - define either the amount of crypto or the US dollar notional value to determine the size of the trade

- Specify your order price - if using a price order, such as a limit or stop, enter the price at which you want to place the order. If using a market order, no price needs to be entered.

- Choose to buy or sell - click on the buy or sell button to submit the order

Order Type

Trades can be submitted with different conditions known as order types. These order types allow traders to specify criteria related to how and at what price a trade may be placed.

CoinList Pro supports several order types, including:

Market

- Description - market orders execute at the next available price in the market. No price is specified with the order, and the order is filled at the current market price

- Use case - traders use market orders to enter or exit a trade quickly when execution certainty is a higher priority than price execution

- Traders should be cautious when using market orders in thinly traded markets where the bid-ask spread may be wide and liquidity may represent an issue for price slippage, causing orders to get filled for a higher price if they are buying, or a lower price if they are selling

A market order is the most straightforward type of order. It executes immediately against the best price available. As long as there are willing buyers and sellers, market orders are filled.

A market sell will match the best available bids on the order book, and a market buy will match against the best available asks on the order book.

Market orders are often used when you need to prioritize speed over price, for example, when taking advantage of a fast-moving bull run. You'll use this order when you need your trade to execute immediately at the current best price available.

Limit

- Description - limit orders are used to specify a price limit at which the order must be executed. Limit orders to buy are placed below the market and limit orders to sell are placed above the market. Since the limit order must be filled at the designated price or better, traders use limits to define the worst price at which the order will be executed, prioritizing price execution over execution certainty

- Use case - traders use limit orders to enter positions, setting orders at points that act as profit targets, as well as to exit positions. Limits can be placed in advance once a position has been entered, and the order will automatically execute once the price conditions have been met

- Since a limit order must be executed at the specified price or better, the market may touch the limit price several times with the trader not receiving a fill, depending on where the trader’s order is in order book queue

- The market must trade completely through a limit order’s price in order for a trader to earn a complete fill and partial fills can occur if only part of the order is executed

- A limit order remains in the order book until the order is either executed, canceled, or expires

A limit order allows you to specify a price and amount you would like to buy or sell at.

Example: If the current market price is 8000 and you want to buy lower than that at 7900, then you would place a limit buy order at 7900. If the market reaches 7900 and a seller’s ask matches with your bid, your limit order will be executed at 7900.

Stop Market

- Description - stop market orders execute at the next available price once the designated trigger price crosses the stop price. Stop orders to buy are placed above the market and stop orders to sell are placed below the market.

- Use case - traders typically use stop orders in an attempt to limit losses if the market moves against a market position or to protect profits on an open position, but the order type can also be used to initiate a new position. Once the stop price is touched, the stop order is said to have been "elected," will be treated as a market order, and will be filled at the best possible price

- Stop orders do not guarantee execution at the stop order price, and price slippage may occur in certain market conditions. Unlike limit orders, stops are not required to be executed at the designated price or better

CoinList Pro supports two kinds of triggerable orders: stops and take profits. These are orders that aren't added to the order book until some price threshold is reached.

Stop Market / Limit

A stop market or stop limit order is an instruction to add a market or limit order to the book once the trigger price has crossed the stop price. By default, the stop price indicates the mark price at which to trigger the stop, but stops may also be configured to trigger on last trade price or underlying index price rather than mark price.

Stop orders rest in the matching engine until the trigger price goes 'outside' the stop price:

- buy - the stop triggers when the trigger price is greater than or equal to the stop price

- sell - the stop triggers when the trigger price is less than or equal to the stop price

Upon triggering, the stop order is converted to a regular market or limit order. This order becomes available for execution in the first auction following the one which triggered the stop. The order will incur the standard fees, as any order inserted at the time of the trigger would.

While it is untriggered, a stop order is invisible to other traders, and is not included in the book. Once it is triggered it becomes visible (as it is now a normal market or limit order).

Note that the time priority of the order is based on the time at which it was triggered, rather than the time at which the stop was last updated.

Trailing Stop

A stop market order may be specified with either a fixed or percentage trail value, which causes the stop price to be pegged to no more than a fixed offset away from the order's trigger price (which is a mark price, index price, or last trade price, depending on the order's specified trigger type).

When the trigger price moves away from the current stop price, the stop price is moved as well, thus the stop price trails the trigger price. (Note however that when the trigger price moves towards the current stop price, the stop price doesn't change, otherwise the order would never trigger.)

For example, on a stop market sell order, setting a $-100 trail value will have the effect of setting the stop price $100 below the trigger price. If the trigger price is $1000 at the time the order is entered, the stop price will be $900. If the trigger price moves up to $1050, the stop price will be updated to $950. If the trigger price then moves down to $990, the stop price will stay at $950, and if the trigger price keeps moving all the way down to $950, the order will be triggered, and will convert to a normal market sell.

In other words, the stop price of a stop sell order will move up along with the market, but is kept constant as the price falls towards the stop (and vice-versa for a stop buy order).

Take Profit Market

- Description - take profit, or market-if-touched, orders execute at the next available price once the designated trigger price (by default, the mark price) crosses the stop price

- Use case - traders typically use take profit orders to exit positions once a price level has been reached although the order type can be used to initiate a position as well. Since the order executes at market once the market trades at the order price, execution certainty is prioritized over price execution

- Take profit orders do not guarantee execution at the order price, and price slippage may occur in certain market conditions. Unlike limit orders, take profits are not required to be executed at the designated price or better

- A take profit order will not be executed if the trigger price fails to touch the take profit specified price

A take market or take limit order is the same as a stop market or limit order, but with the trigger directions reversed. That is:

- buy - the take profit order triggers when the trigger price is less than or equal to the stop price

- sell - the take profit order triggers when the trigger price is greater than or equal to the stop price

Post-Only Order

The post-only order is a limit order that ensures the order will be added to the book and not match with a pre-existing order. If your order matches with a pre-existing order, your post-only limit order will be rejected.

The Post-Only Order ensures that you will receive the maker rebate, and not pay a taker fee. It prevents placing a limit buy order that matches against the sell side of the order book (and vice versa, for sell orders), which would normally result in taker fees.

Maker and Taker Definitions

In theory, a Maker is an order that adds liquidity to the order book and a Taker is an order that removes liquidity.

In practice, there are some edge cases on CoinList Pro that one should be aware of.

1. A market order is a taker unless:

- It remains unfilled (due to price protection) and sits on the orderbook for longer than one auction

2. A limit order is a maker unless:

- It crosses in the current auction AND it crosses at a price that is through the previous auction price

- Through the previous auction price means a buy that is higher than the previous auction or a sell that is lower than the previous auction price

- It crosses in the current auction AND it crosses at a price that is equal to the previous auction price AND it is on the side (buy or sell) without any unfilled orders

Price Protection

In order to prevent prevent large slippage on the exchange, CoinList Pro employs price protections on its market and limit orders.

Price Protection of Market Orders

This is the maximum (buy market) and minimum (sell market) price that can be executed via a market order. If a market order has remaining unfilled quantity, it will effectively become a resting limit order at the maximum/minimum price.

- Market buy limit protection price = best ask * (1.05)

- Market sell limit protection price = best bid * (0.95)

Price Protection of Limit Orders

This is the maximum buy limit and minimum sell limit price that can be submitted via a limit order. There is no minimum limit on a buy limit price or maximum limit on a sell limit price.

- Buy Limit Price Maximum: Reference Price *(1.05)

- Sell Limit Price Minimum: Reference Price *(0.95)

- Buy limit orders more than the Buy Limit Price Maximum and sell limit orders less than the Sell Limit Price Minimum will be rejected

If an order is a Stop Limit Order, the Reference Price is the Stop Price, otherwise it is chosen in the following order:

1. Last Trade Price

- if the last auction did not have a fill, go to 2

2. Best bid if it is higher than, or best ask if it is lower than, the previous midpoint quote.

Viewing Orders

Viewing Actively Working Orders

All orders that are actively working in your account can be viewed in the orders module. This will include orders for all pairs you are trading as the default, which can be filtered to the currently selected asset to focus exclusively on one trading pair.

Viewing Historical Order Activity

CoinList Pro’s “Orders” module shows your order history, including orders that have been filled, canceled, and rejected.

Viewing Filled Orders

CoinList Pro’s orders module shows your filled orders in two different places: Fills shows you exclusively filled order activity and Order History shows fills along with other order activity.

Closing a Position

Open positions can be quickly closed and all working orders for a contract can be canceled when using CoinList Pro’s order book in trade mode.

To close an entire position and cancel all working orders for a particular contract, click on the manage dropdown and select Close Positions.

Note: This feature uses a single market order to close the position, which could impact the price at which the position is closed depending on market conditions and liquidity when the order is placed.

Closing Positions Quickly

Open positions can be quickly closed and all working orders for a contract can be canceled directly from CoinList Pro’s positions module.

To close an entire position and cancel all working orders for a particular contract, click on the X next to the contract position you wish to close and select Close Positions.

Note: This feature uses a single market order to close the position, which could impact the price at which the position is closed depending on market conditions and liquidity when the order is placed.

Trading from the Order Book

CoinList Pro’s order book can be used to place trades and manage orders directly on the order book, allowing you to take trading action while you view market depth.

Order book trading includes:

- Placing market orders

- Placing price orders (limit, stop, take profit)

- Quick order size presets

- Position size

- Modifying the price of working orders

- Canceling individual orders

- Closing a position at market

Entering Order Size

Your order size can be entered in two ways when using Order Entry to place an order:

- Quantity of base asset - choose the amount of the asset you want to trade